To go about creating a cost estimate you would likely start by tallying the obvious expenses. Postage and courier fees, paper and ink, etc. These common hard costs can certainly add up, but they also don’t come close to telling the full story.

The true cost of paperwork stems from the inefficiency and inconsistency that it introduces into business processes. Paper based processes are slow. Paperwork gets lost. Manual paper processes leave a lot of room for human error. Paperwork is inefficient.

Time spent dealing with paperwork is time that could be spent tackling something else that needs doing. There aren’t many small businesses that have a lot of idle hands sitting around, which leaves three possibilities: employees must work longer hours, a new hire must be made to pick up the slack, or something just doesn’t get done.

This is not a trivial amount of time or money either. Chances are the costs associated with wasted productivity far exceed whatever is being spent on the hard costs mentioned above. For many organizations, the amount of money unwittingly spent on wasteful processes would be truly shocking.

Take accounts payable and receivable as an example. It’s estimated that the average finance worker spends 49 percent of their time processing transactions. That’s roughly half their day filling out forms and dealing with invoices.

So what are the direct labor costs of all that transaction processing? Let’s consider a hypothetical company to put it in context: a regional chain of bicycle shops in Seattle.

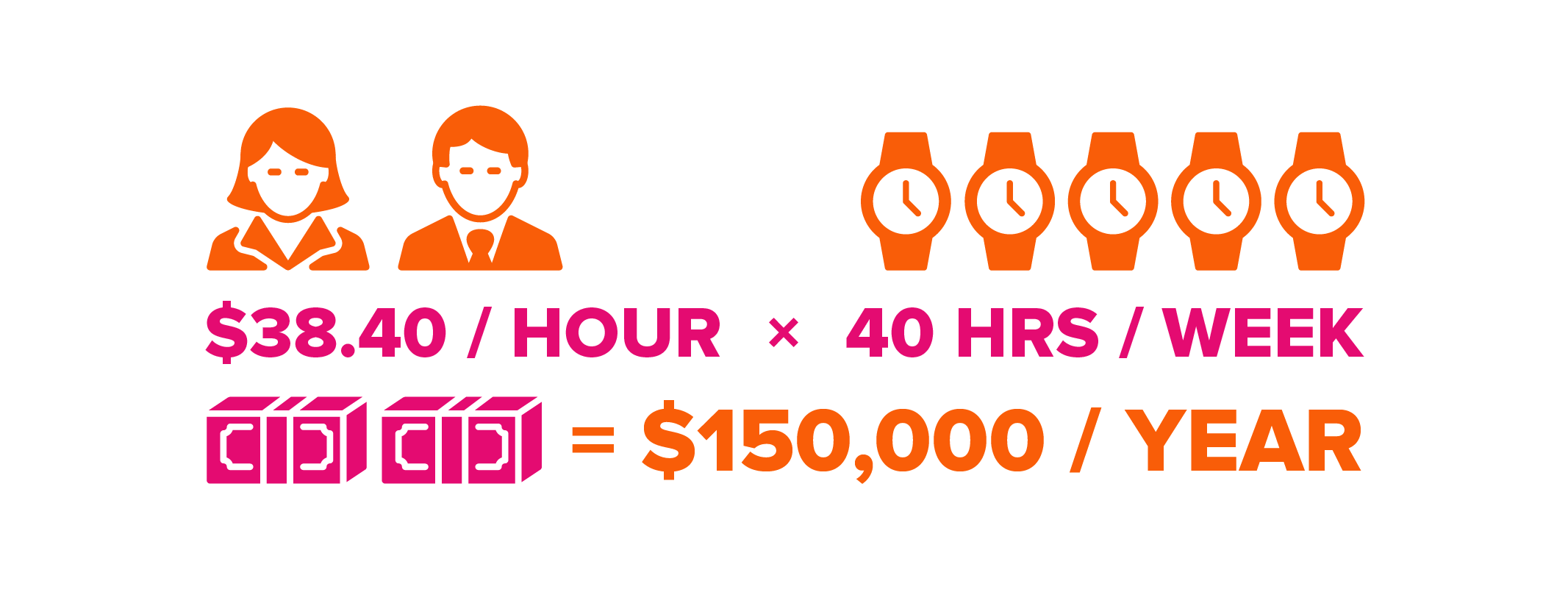

Our example business has four locations and about 40 full-time employees, two of whom are focused on finance. According to the Bureau of Labor Statistics, the mean hourly wage for a business and financial operations worker in the Seattle area is $38.40. Assuming 40-hour-average workweeks for 50 weeks a year, the labor cost this company incurs paying its finance employees to process transactions would exceed $150,000 annually.

This is an admittedly simplistic way of looking at the problem of course. Not everything that goes into processing transactions is inherently “wasteful” and there’s no way to completely eliminate the need for it. Even so, the opportunity costs are very real. Finance employees are high-skill, high-pay knowledge workers, so if they’re spending hours filling out paperwork the expense is felt in both dollars and misallocated brain power.

This estimate also doesn’t even consider the range of non-labor expenses that can arise from paper-based financial processes. In addition to hard costs associated with creating, sending and storing physical documents, having less reliable records increases the risk that businesses will have problems with compliance, information security, taxes or general liability.

So if we accept that wasteful paperwork is a very expensive wrench in the productivity works of most businesses, what can we do to reduce its impact or remove it altogether? Digitization can go a long way towards achieving that goal and accounts payable is a great place to start. From there, some tedious manual processes can be streamlined or eliminated completely with workflow automation. With the right technology and the right partner, reducing wasteful processes can have an immediate impact on the efficiency of your business as well as your bottom line.

Tags: Blog