Accounts payable text on blackboard with businessman on side

Accounts payable text on blackboard with businessman on side

Accounts payable is one of those business-critical departments that likely conjures a fairly intimidating scene in your head — frazzled-looking people poring over files, comparing numbers, tracking down approvals, paying invoices, worrying about regulations.

There is no doubt that employees in accounts payable do some very difficult work that their employers can’t do without. Automation can make that difficult work much more manageable, and many companies would be happy to give their workers a more streamlined and less intensive process. Unfortunately, other business initiatives — usually customer-facing— tend to dominate focus, and accounts payable often fails to get the attention it deserves.

There are three reasons that situation is due for a change. One is that the benefits of automation, for both the company adopting these services and the vendors it works with, are too profound to overlook. Add to that a less burdensome path to implementation and new mobility features, and automation becomes a tempting solution for any business processing large amounts of invoices.

Benefits of automation

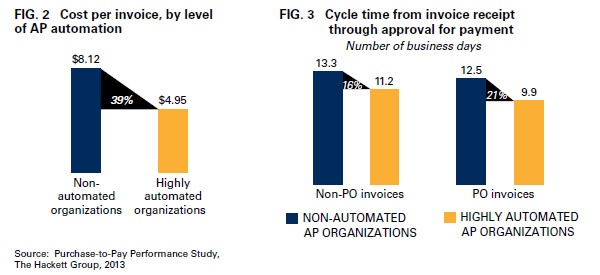

From a strict cost-benefit standpoint, automation technology is now powerful enough to make a very persuasive case. A white paper by The Hackett Group, a worldwide consulting firm, shows that the more businesses automate their accounts payable systems, the more they reduce costs and transaction times.

Saving almost 40 percent per invoice will add up to sizable savings very quickly. Based on the values in the chart above, a company processing 400,000 invoices annually will save $1.27 million — far more than it costs to invest in and implement automation.

The savings in transaction time — valuable in their own right — point to further benefits. Accounts payable has to handle standard invoicing as well as special cases, and those exceptions to the rule can require lots of time and attention to resolve. With automation software looking after the invoices that fit the rule, workers in accounts payable can afford to focus on the exceptions. It’s the ideal division of labor for a department with a mixture of systematic tasks and issues requiring real problem solving.

Finally, automation can help companies realize the benefits associated with early payment discounts. Earning the discount requires first identifying and then processing particular invoices by a particular date. And if an AP clerk has a stack of invoices to process, those particular invoices may not be reached in time. Opportunities for savings may fly out the window — all because of the pace and tedium of a manual process. With every business placing a premium on cash management, every business wants to benefit from the discounts available to them. An automated procedure can help them do just that.

More accessible to more businesses

Despite the benefits, the costs of implementing automated processes have traditionally been a barrier. With a limited IT budget, priorities tend to fall elsewhere. But automation solutions provided by third parties are much more accessible now, thanks in large part to their deployment as software-as-a-service (SaaS). Rather than investing in expensive new hardware, companies can utilize their vendor’s infrastructure and still get the benefits of automation. And rather than paying large upfront costs, they can purchase the service on a subscription, as-needed basis. This gives immediately recognizable ROI: By spending less upfront, the savings brought about by automation are more swiftly apparent.

Mobility

Though aware of the savings in cost and time, businesses may still have found automation in accounts payable a leap not worth taking. Those businesses will be glad to know that there is now an additional benefit: mobility.

As long as accounts payable remains manual, requiring workers to be in their offices to do their jobs, it won’t operate with the speed and flexibility that are the hallmark of business processes today. With mobile connectivity, however, processing an invoice or getting approval can happen much more quickly. And when waiting time is reduced, productivity is increased. By putting workers in touch with invoices regardless of time and place, mobility also cuts down on the possibility of late payments — always a chief concern in accounts payable.

Closing thoughts

Automating processes within accounts payable has long been an appealing idea. But implementation was burdensome, and budgets tended to favor other upgrades that appeared — at the time — to be more strategic. Now, with the ease of SaaS deployment and the flexibility of mobile capabilities, upgrading accounts payable can be both more attainable and more strategic.

The savings in time and money can be vast — and the low costs and barriers to entry make these upgrades available to companies that previously considered them out of reach. Are you ready to get started?

Tags: Blog